AceMoney Tutorial

So, assuming that you’re convinced of the necessity of personal financial management, and you don’t intend to take up the study of accountancy, how do you accomplish these goals without hiring an expert? one solution is to pay a visit to a CompUSA store for the latest monster application with great specs and an overwhelming number of features… most of which you may never understand, let alone actually use. Lucky you — you’re reading just what you need to read to find a real alternative from people who have been doing their own personal financial management for years. We offer you a small, fast and inexpensive application that won’t cause you heart attacks with dialog-box messages reading, for example, “Uploading your financial data to our Web site…” (No kidding — one well known financial application actually did that with users’ private financial data!). So, I want to thank you for your interest in AceMoney. I’m convinced you’ll find it the right application for your needs.

First of all, let’s talk about accounts and transactions. These are the key concepts of personal finance management, and even if you think that they sound too scientific – trust me, they are not!

A transaction is a record that changes your account balance. You’ve probably seen a lot of them in credit card statements: charges to the grocery store or department store, credit for returned goods, and bill payments, for example. For our purposes let’s define three major transaction types: deposit (when you add money to the account), withdrawal (when you spend money from the account) and transfer (when you transfer money from one account to another). A transaction can be described with an amount of money, a spending category and a payor or payee.

Amount is simple – it’s just a sum of money. Sometimes the amount can be split, though, such as when part of the money from your paycheck goes to Uncle Sam and little bit goes to you, too. In terms of personal accounting it’s still a single transaction, but it has multiple “subtransactions” inside. The ability of your software to handle subtransactions is a big part of what makes AceMoney work intuitively for you.

Spending Category provides you a tag for planning and reporting purposes. At the end of the month it’s very interesting to know how much you’ve spent on toys for your kids (or electronic toys for yourself) and clothing for your spouse. When you plan your budget, you probably want to set limits on spending by categories. That’s why categories are so important. You can live without them if all you need is to have a copy of your bank statement in the PC and to find inconsistencies at the end of the month, but having them gives you a whole new level of control over your money. It’s even more interesting — and shocking, sometimes — to get a whole year’s summary of spending by category. (You spent how much at the pub?!)

Payee is just a person or company (a supermarket or gas station, for example), that receives money paid from your account. A payor is one — such as an employer — who pays you In AceMoney, we will identify this entity at the other end of your transactions as payor/payee. At the end of the year you might want to analyze how much money you’ve spent at Costco or Sam’s Club to evaluate the wisdom of paying the annual fee for these stores.

Account is a list of transactions. The easiest example of an account is cash in your pocket. Some accounts may be linked with the bank; you might want to keep information about that in your records along with the bank’s phone number. Don’t forget that from now on you have control over the transactions in each of your accounts. Before now you might have paid a credit-card bill without noticing the wrong amount charged by a careless or dishonest vendor. Now you have a way to catch these errors.

New Account

It seems to me that now you know quite enough to start. Let’s create your first account. One hundred per cent of the world’s population has a cash account. I don’t know how people pay each other at the North Pole, but they must have some cash, anyway.

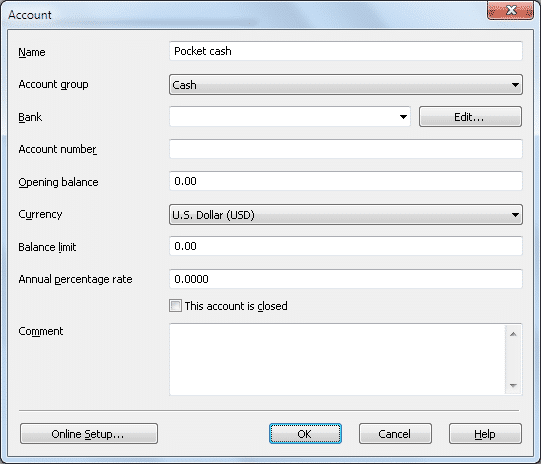

Start AceMoney, go to Accounts menu and select Add new…. A dialog box will pop up onto the screen. Give a descriptive name to your account, select the account type cash and click OK.

|

|

New transactions

Now you’ve got an account set up. Double-click on it in the list of accounts and you’ll find yourself in the account registry. It’s time to add some transactions. Let’s think positively and add some income — a new paycheck, for example. As I mentioned before, a paycheck in real life is a split transaction. Depending on your employer, your net pay may be the bottom line of gross pay, tax deductions, 401k matching, insurance, etc. If you want to keep all that detail in your records, add a new transaction and instead of assigning one category to it, click on the Split button and insert all the deductions as separate items. If you prefer to choose the easier way and calculate taxes at the end of the year, instead, just add the transaction with single category — Wages, or salary.

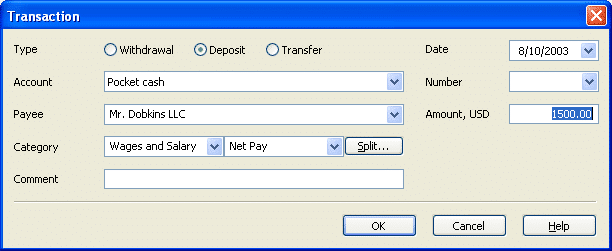

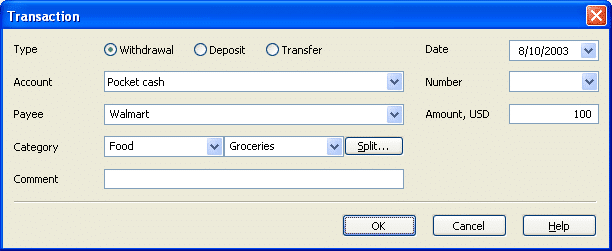

Let’s suggest that the name of your employer is Mr. Dobkins LLC and he pays you 1500 dollars. Click on the New Transaction button and fill in the dialog box like that:

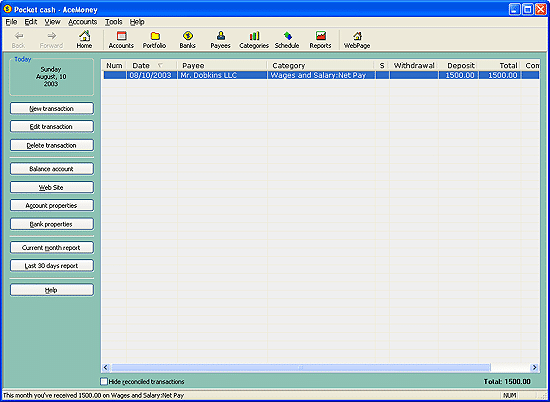

When you click OK, you’ll see the following:

Congratulations — you’ve just entered your first transaction. Your account balance is $1500, and life is full of joy. Only one little thing: you already had about 1000 in your pocket before the paycheck was received. The fix is easy — click on Account properties and add this number as a starting balance. Click OK and the account balance is $2500.

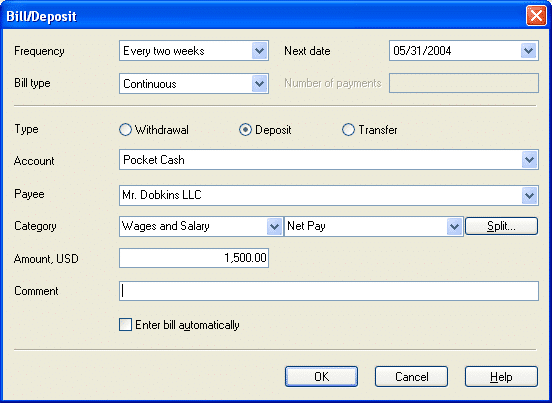

So, you’ve got a paycheck. Now it’s time to do some shopping. You visited Wal-Mart and spent 100 bucks there on groceries. This should be added to your account information:

Now you’ve got $2400 in the Account Balance box. The transaction that you just entered is very good: it has a category and a payee. If you wish to generate a report, AceMoney will use that important information to produce a report by category or by payee, or will use both.

Basically, that’s it. Now you understand the concept. Track all your expenses and income this way. Add categories and payors/payees to every transaction.

Tips

You probably already have checking, savings and several credit card accounts. Once a month you might want to reconcile the bank statement with the information you’ve entered into AceMoney. This is easy: just mark the transactions from the statement as reconciled. Right-click on the transaction and choose reconciled from the menu.

Sometimes you might decide to trust the bank and keep the personal records in AceMoney just for reporting purposes. If your bank allows you to download statements in QIF format, consider yourself a lucky person: AceMoney understands this format. Just download a statement, save it as a file on your hard drive and then choose File->Import from the AceMoney menu. Open a file, select an account and then check what’s in there.

Some of us borrow money, and some of us give loans to other people. AceMoney allows you to deal with that in two different ways. The easiest way is to create a category “Loan:Name of your debtor” and generate transaction reports against it. The total balance in the report will tell you a state of this loan. The second way is a little bit more complex. Create a new account for the person who owes you. Your loan to him will be a transaction from your account to his account. When he repays the debt, the current amount is always visible at the account list screen; you don’t have to regenerate a report. When the debt is paid off, just close the account (mark it as closed in the account properties dialog.

Define recurring transactions like paychecks or utility bills in the Schedule screen. When a bill comes it, just hit the Enter key and accept the transaction. For example, the paycheck described above can be there as shown in the following picture:

What’s next?

Play with the application. Everyone has his own version of personal financial management. Find the way you like and stick with it. And of course, don’t forget to back up your data at least twice a month. It is pretty hard to restore this kind of information without a backup.